A reflection on summer 2021 for Business aviation

The COVID19 crisis had effects on our society as a whole, with a considerable impact on global air transport in particular. As aircraft are by nature borderless, the closure of borders by Governments has led to a disruption of aviation as it was then known and all the industries that depend on it (tourism, hotels, etc.).

The air transport system, developed over the years, was not designed to slow down and even less to stop, but the Covid-19 pandemic brought it to an abrupt halt. Eighteen months later, air transport remains far below its pre-crisis levels, and the most optimistic forecasts speak about years of recovery.

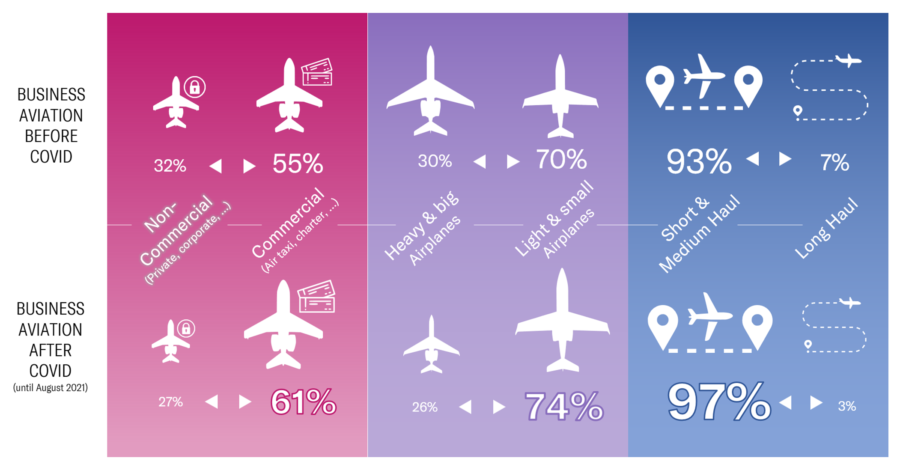

Alongside the ‘regular aviation’ behemoth, business aviation (7% of air traffic in Europe) has always been an industry of constant adaptation. In its very nature, business aviation flies “on-demand”. As such, business aviation is more equipped to face the unexpected. Since March 2020, it has experienced distinct periods [1], which are the direct result of the impact of the pandemic on the European aviation system.

The summer of 2021 is one of these unprecedented episodes, and the aim here is to present some of its main characteristics. At the first stage, it is interesting to see the aggregate figures, which give an overall picture of the state of the industry. However, Business aviation is a remarkably diverse industry, and it is essential to analyse it from certain angles to discover some of the significant changes that are taking place.

[1] examples of the different episodes of the COVID crisis on European Business aviation: the first weeks of the pandemic around February-March 2020, – the months of April-May 2020, the summer of 2020, the period from September 2020 to May 2021.

AGGREGATED VIEW – SUMMER 2021

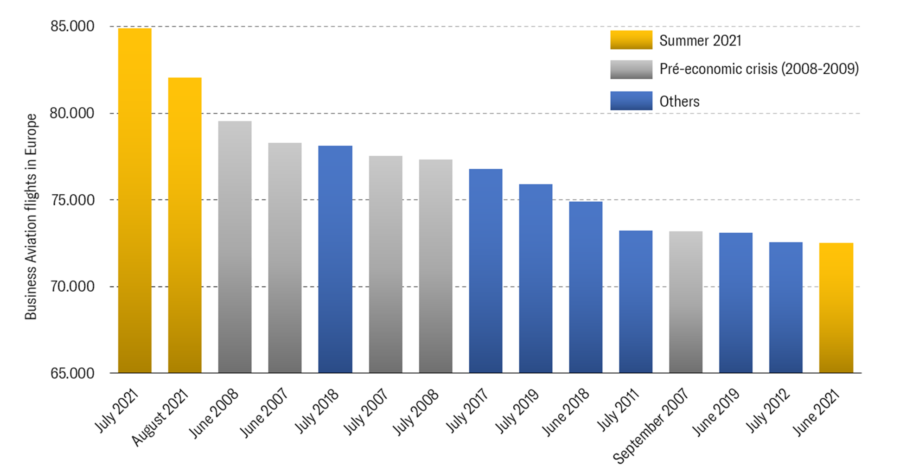

After a record-breaking July 2021 (busiest month in the history of European business aviation, +12%), August hits even more robust, reaching a level of activity of +25% compared to August 2019. That’s 17,000 more flights than two years ago (550 more flights every day of the month). With 82,052 flights, August 2021 is the second busiest month in the history of European business aviation (after July 2021).

Summer 2021 overview in the main European markets in comparison with pre-covid levels:

Summer (June-July-August) 2021 VS 2019

- Austria : +25%

- France : +7%

- Germany : +14%

- Italy : +15%

- Spain : +20

- Switzerland : +20%

- United Kingdom : -10%

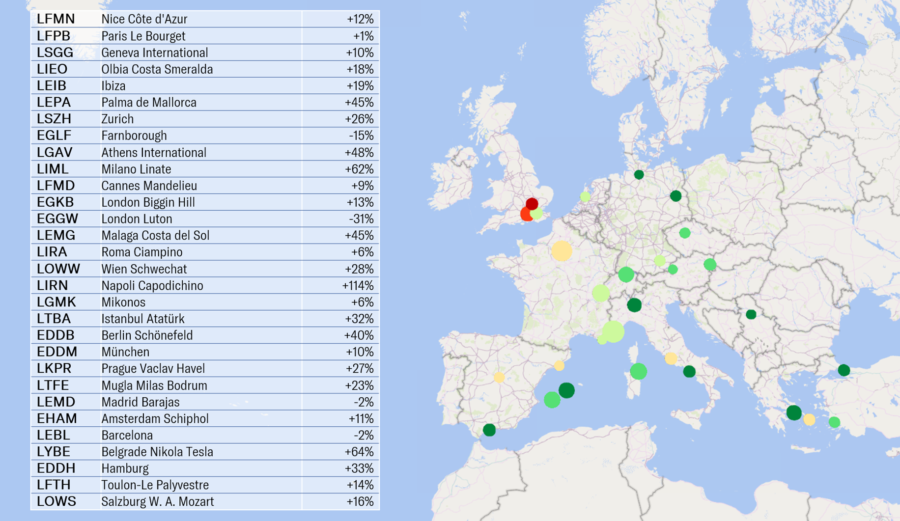

In Summer 2021, the main business aviation airports widely recorded performances similar to the European trend (compared to summer 2019).

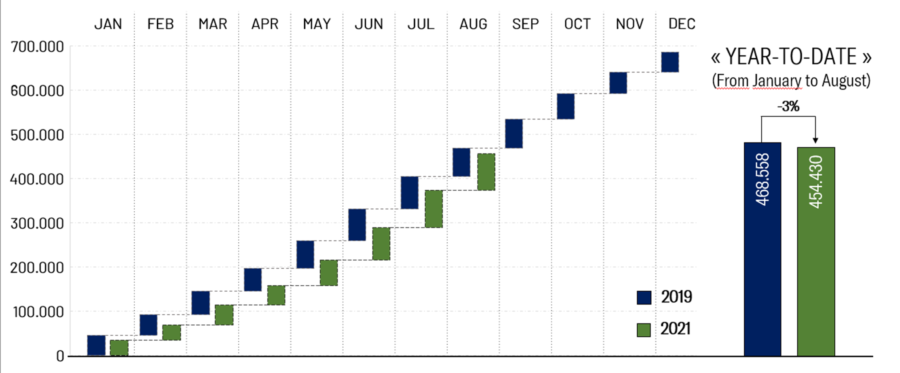

AGGREGATED VIEW YEAR-TO-DATE 2021 (from January to August)

Taking into account a poor start of 2021, with business aviation still heavily impacted by Covid (between -20% and -10% in the first months of 2021), the strong performance of the summer is catching up, and the cumulative levels of 2021 are now equivalent to 2019 levels (-3%).

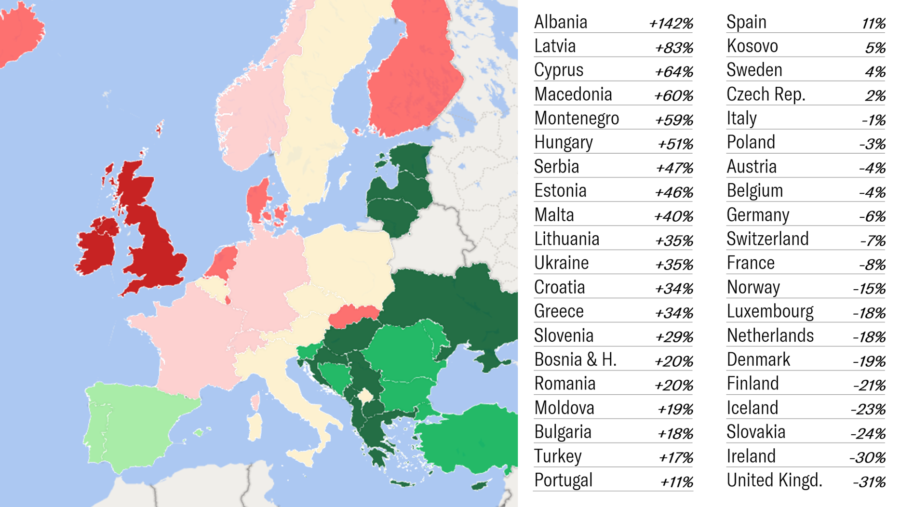

Despite the historical summer performances, the Year-to-date (January to August 2021) figures are very different depending on the country.

Compared to airlines, business aviation has adapted faster to the effects of the crisis. In August 2021, airliner traffic is back to its best performance since the crisis’s beginning and remains at -40% of its normal levels.

DETAILED VIEW – WINNERS AND LOSERS

The performance of business aviation in the 2021 summer in general, but the entire Covid crisis has triggered some trends shifts, which were confirmed all over the period.

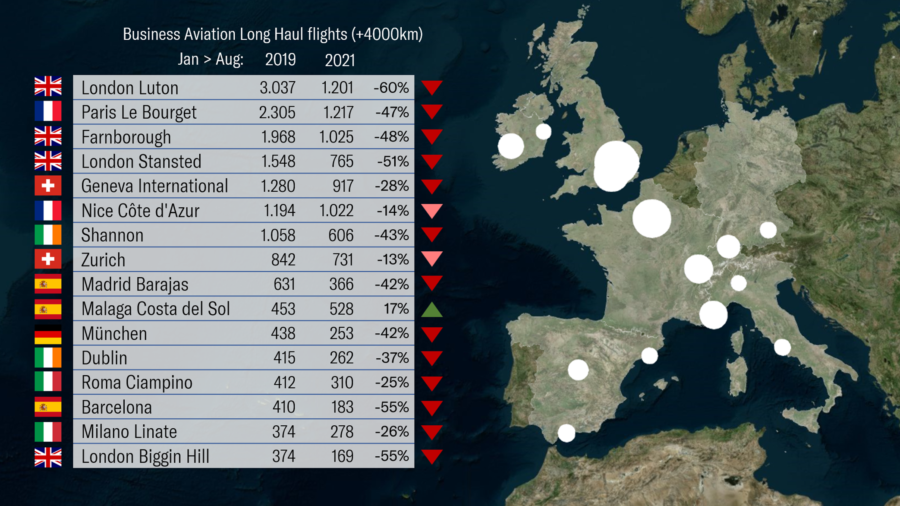

Major changes are to be highlighted in the intercontinental markets:

- The Russia-Europe market has quickly returned to normal levels (as of summer 2020), although in terms of routes, it is slightly different.

- The Europe-North America market was very hard hit by the crisis and has remained at around -50% of normal levels for almost a year and a half (although there is an upturn in activity in August 2021).

- The African and Middle East markets have slowly but surely returned to normal levels.

Long-haul business aviation was the most affected segment during the pandemic. While the number of flights is small, the revenues associated with them are often substantial. As a result, the various industry players that depend on this specific part of the market have suffered severe financial consequences. The map below shows the main airports in Europe for the long-haul market. From an economic point of view, 2021 is far from the upturn seen in the rest of the industry.